Blockchain for Finance

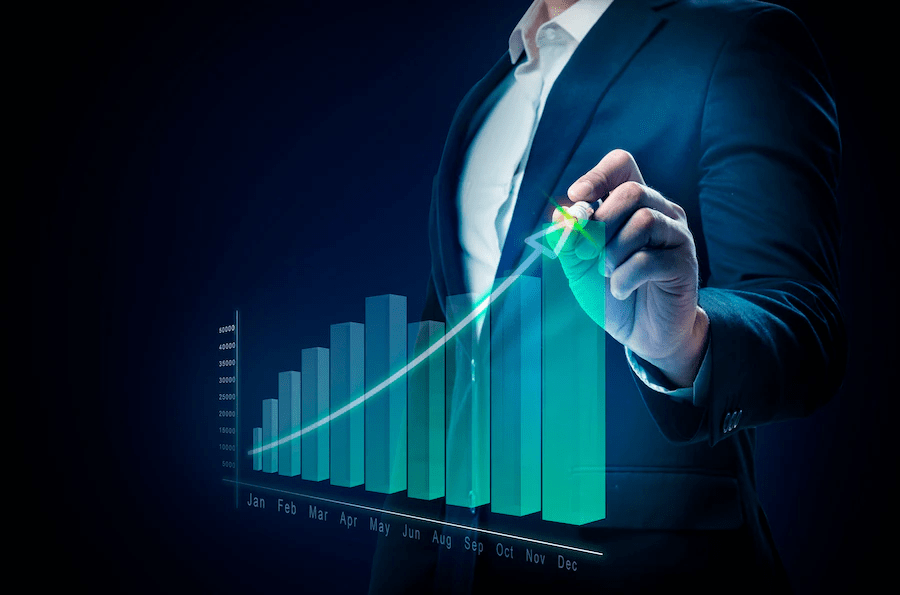

The financial sector has come to understand the game-changing potential of blockchain technology to increase revenue, boost process efficiency, enhance the end-user experience, and lower operational risk.

Blockchain for Finance

The potential of blockchain technology is about to change the world’s financial system. The foundation of the incredibly appealing decentralized system provided by the Founding Blockchain is the global accessibility to the open data supported by the most secure modern blockchain platform. In addition to having an unmatched ability in developing the best methods for diverse scenarios, our talented blockchain engineers know the risk, strategy, legal compliance, and tax departments. With a crew of quality professional workforce that is constantly expanding, we have a fully staffed blockchain department, talented engineers, enthralling content creators, and amazing marketers. By taking control of your financial operations, the Founding Blockchain lowers the risk of fraud and loss while boosting your company’s overall growth and productivity.

Benefits Of Adopting Blockchain Financial Solutions

Transparent Transactions

Transparency in transactions, compliances, and other industry procedures is improved through decentralized finance.

Security

The blockchain network would distribute and store the financial data as cryptographic hashes, making it hard to hack.

Instant Processes

Global validators for blockchain financial applications continuously and instantly validate transactions.

Dispute-Free

To provide traceable facts in the event of a dispute, the blockchain ledger preserves transaction data in chronological order.

Accessibility

In accordance with blockchain applications, the financial industry may provide equivalent banking services to those who are underbanked or unbanked.

Use Cases Of Blockchain Financial Solutions

Cross-Border Transactions

Financial operations including reconciliation, KYC verification, and report preparation will be made simpler because every transaction is added to the ledger after being approved.

Investments

All stakeholders now have the chance to invest in the shares they choose or conduct trade without any limitations thanks to blockchain financial solutions.

Simplified Processes

International payments might be completed in a matter of minutes with the help of blockchain financial apps at a low cost per transaction.

Tokenization

Tokenizing their holdings will allow financial network stakeholders to earn higher returns than they would under more conventional arrangements.

Instant Lending

Investors can use smart contracts and peer-to-peer financing to fund education and start-up firms in blockchain fintech applications.

Smart Deals

With the use of smart contracts, blockchain financial services may automate loan agreements, contracts, repayments, and other delicate transactions to assure their security.

The Current Problems In Founding Blockchain

Increased Competition

Companies don't miss an opportunity to enter the market with cutting-edge methods and attractive products since the services offered by financial technology enterprises are in great demand. As a result, conventional banks struggle to adapt to the new changes and eventually lose money.

Lack of Public Confidence

There is significant pressure on banks to provide the best results; nevertheless, many banks now fail to live up to client expectations, particularly when it comes to technology.

Regulatory Pressure

Most banks find it difficult to keep up with the ever-increasing regulatory requirements, which forces them to spend a significant portion of their budget on compliance.

The Scope OF The Blockchain For Founding Blockchain

We are the best in the industry to craft the most profitable and secure NFT marketplace by learning every company’s prime requirements.

Customer Oriented

Blockchain technology is used to automate the process of creating an account with the data sharing capability via a digital ID.

International Payments

It is feasible to make global, round-the-clock digital internet payments using this method.

Education Lending

Using the blockchain platform for lending has become considerably more cost- and time-effective as millions of students worldwide take out student loans.

Open Banking

Creating a framework for consumer protection and security in light of the ever-increasing data sharing.

Insurance

Redefining one of the most popular financial sectors with innovations including risk-free underwriting,on-the-spot buying, and secure claims processing.

Credit Scoring

People can engage in the financial sector by improving their credit ratings through blockchain-based loans.

Investing

Digital investments made on the blockchain platform allow investors to profit via receiving high returns

Cybersecurity

The nature of blockchain technology ensures that data is safeguarded and rendered unchangeable.

— 98% Customer Satisfaction

Hear from

happy

customers.

"A satisfied customer is the best business strategy of all "

- Michael Lebouf

We approached founding blockchain to develop an end-to-end cryptocurrency exchange with a strong backend system. We wanted a simple yet elegant product. They provided us with a one stop cryptocurrency exchange that covered almost all components like digital wallet, exchange, liquidity, trading engine and admin panel. Their product can support 50+ cryptocurrencies. I am grateful to the team and their support.

Rachel Griffith

GMX Exchange

We have 3 projects with founding blockchain and that is because we found them extremely competent, dedicated, diligent and professional. Thank you to everyone at Founding Blockchain in meeting our expectations. It is a pleasure working with them.

Justin Michael

Meet One

Founding blockchain did a splendid job of delivering what was required. The team conducted a series of meetings beforehand to understand all the requirements. During development, their communication was top of the game. They have an experienced team that helps keep a lid on the costs. Loved their transparency and professionalism.

Steve Anderson

Edge global

We had a very bad experience working with freelancers as nothing ever really took off. Thanks to one of my colleagues who recommended Founding Blockchain to us. Not only did they guide us in the right direction but their work actually made our business profitable. I strongly recommend them.